Innovative Game Mechanics Reshape Player Choices in 2025: A Data-Driven Analysis

Over the past six months (April through September 2025), we at Casinoble tracked something most people in iGaming talk about but rarely measure properly: which game mechanics actually win in different markets. Not which games have the best graphics or the biggest marketing budgets—but which core mechanics consistently land in top-10 lists across different countries.

We used our GeoWeight dataset, which standardizes top-performing games across markets and groups them by their core mechanic rather than their theme or brand. The question we wanted to answer was simple: when you strip away the visuals and the IP, what are players really choosing?

The timing matters too. We’re now far enough into 2025 to see patterns that aren’t just launch hype or seasonal spikes. These six months capture sustained player preference across diverse markets, economic conditions, and competitive landscapes.

The Big Picture: Two Very Different Worlds

What jumped out immediately is that Arcade and Slots are two separate industries.

Arcade games are all about immediacy—drop physics, timing windows, instant visual feedback. Think Plinko, Crash, Dice. Players are making micro-decisions constantly, and each round takes seconds. The entire experience is designed around rapid iteration: bet, watch, resolve, repeat.

Slots are the opposite: structured, rhythm-based, and designed around volatility expectations that players already understand. Even when slots try to innovate, they’re usually adding layers on top of that familiar base rather than replacing it. The slot player isn’t looking for surprise mechanics—they’re looking for variance within a framework they trust.

We split our analysis into these two categories because mixing them would hide what’s actually happening. Aggregating Arcade and Slots into one “casino games” bucket would be like lumping action games and puzzle games together. The player motivations are fundamentally different.

Arcade Mechanics: Plinko Isn't Just Winning, It's Dominating

Here’s what the global numbers look like for Arcade:

- Plinko: 54.1% (20 out of 37 top-10 appearances)

- Dice: 18.9% (7 appearances)

- Slingo: 10.8% (4 appearances)

- Crash: 8.1% (3 appearances)

- Instant Win: 5.4% (2 appearances)

- Other: 2.7% (1 appearance)

This chart visualizes the Arcade Mechanics Index, showing how often each mechanic appeared in national Top 10s from April to September 2025. Plinko dominates with 54 percent of all appearances. In comparison, Dice and Slingo follow at 19 and 11 percent respectively—evidence that simple, low-friction designs outperform higher-pressure formats like Crash on a global scale.

Let me be honest—I expected Crash to rank higher. Culturally, it feels like Crash is everywhere. Walk into any iGaming conference, and half the demo stations are running some variant of a Crash game. But when you actually count top-10 appearances across diverse markets, Plinko crushes it. More than half of all Arcade top-10 appearances globally are Plinko variants.

Why Plinko Works

My read is that Plinko nails three things at once:

It’s immediately readable. Drop a ball, watch where it lands. No learning curve. A five-year-old understands Plinko. A 75-year-old understands Plinko. There’s no tutorial needed, no rules to parse.

It’s mobile-perfect. One tap to drop, visual payoff in 2-3 seconds, repeat—no zoom controls, no landscape-mode requirement, no precision timing that breaks on a laggy connection. You can play Plinko one-handed on a subway.

It feels fair. The physics are visible. Players see the path and accept the outcome. Even when they lost, they watched the ball bounce. There’s no hidden RNG moment, no black-box calculation. The randomness is embodied in the visible physics.

Compare that to Crash, which requires you to trust an invisible multiplier curve and make a split-second decision about when to cash out. That works great for a certain player type, but it’s a higher cognitive load and higher anxiety. Plinko is emotionally lower stakes, which paradoxically makes it easier to play repeatedly.

The Secondary Tier: Dice and Slingo

Dice comes in second at 18.9%, and honestly, that makes sense—it’s the closest thing to a pure random event you can get, dressed up with just enough UI to feel engaging. Dice games are gambling reduced to its essence: pick a number, roll, win or lose.

Slingo holds its own at 10.8%, especially in the UK and Nordic markets where bingo mechanics have cultural weight. Slingo is fascinating because it’s a true hybrid—it has the mark-off satisfaction of bingo but the pacing of slots. The fact that it shows up in nearly 11% of Arcade top-10 appearances globally suggests there’s real value in that crossover.

Crash’s Concentrated Strength

Crash’s 8.1% tells a different story. It’s huge in specific markets (parts of LATAM, certain Asian countries), but it doesn’t travel as universally as Plinko. That concentrated strength is valuable, but it means Crash needs a localized go-to-market rather than a blanket global push.

When Crash works, it works intensely. The social dynamics are real—players watching the same curve, deciding together when to bail. But those dynamics require critical mass. Crash in a ghost town lobby is just a twitchy betting interface. That’s why it spikes so hard in certain markets but struggles to gain traction where operators haven’t built a community around it.

Slot Mechanics: Tradition Isn't Boring, It's What Works

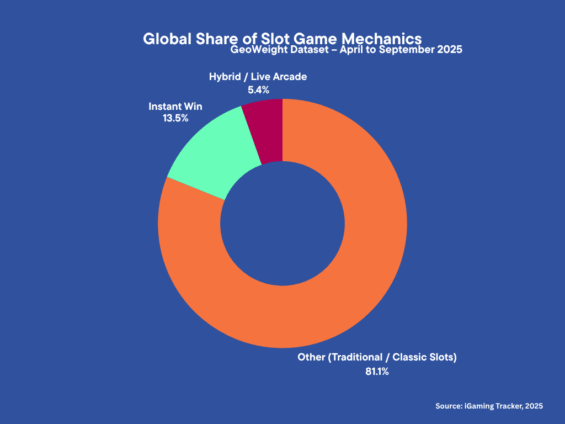

The Slot side is almost the inverse of Arcade:

- Traditional/Classic Slots: 81.1% (30 out of 37 appearances)

- Instant Win: 13.5% (5 appearances)

- Hybrid/Live Arcade: 5.4% (2 appearances)

This chart illustrates Slot Mechanics Index for April–September 2025. Traditional formats account for more than 80 percent of Top 10 placements, confirming that familiarity and predictable volatility remain core player preferences. In comparison, Instant Win and Hybrid Live variants together represent just under 20 percent of the market.

Four out of five top-performing slots are just… slots. Reels, paylines, or ways, volatility you can predict, RTP you can trust.

Some people in the industry see this as a problem—like slots need to “innovate or die.” I think that completely misses the point. Stability is the feature. Players who choose slots are choosing a known rhythm. They want variance within boundaries they understand, not a new mechanic to learn every month.

Why Classic Slots Endure

There’s a reason slot cabinets in Vegas haven’t fundamentally changed in decades. The core loop—bet, spin, resolve—is a solved design. It works. Players understand the volatility contract: low-volatility slots pay often but small, high-volatility slots pay rarely but big.

When you choose a slot, you’re choosing predictable pacing, readable outcomes, and a familiar framework for volatility. Innovation in slots doesn’t mean reinventing that loop—it means optimizing it with better animation, clearer UI, smarter bonus triggers, and more transparent RTP displays. The 81.1% traditional share isn’t stagnation, it’s validation.

Instant Win: The Second Gear

That said, the 13.5% Instant Win presence is interesting. These are typically slots that add an instant-reveal layer—scratch cards, pick-and-click bonuses, cascade mechanics that resolve immediately. It’s not reinventing the slot; it’s giving the slot a second gear for pacing variety. And it works.

The appeal is obvious: you get the comfort of the base slot loop, but every so often, you hit a feature that resolves instantly. No suspense, no animation delay—just tap, see your prize, done. For players who find traditional slots a bit too slow but don’t want full Arcade pacing, Instant Win layers are the perfect middle ground.

Hybrid/Live Arcade: Niche But Strategic

The Hybrid/Live Arcade slice (5.4%) is tiny but worth watching. These are titles that borrow from live casino presentation—hosts, countdowns, communal moments—without abandoning the slot structure.

This is a retention differentiator for sophisticated markets, not a mass-market play. It’s too production-heavy to scale broadly, but for operators targeting high-value players in mature markets like Europe or parts of Asia, it adds a premium feel.

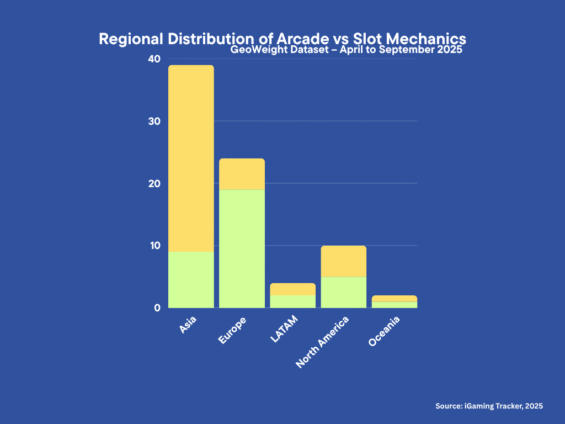

This chart compares the spread of Arcade and Slot mechanics across major regions in 2025. Europe and Asia show the widest mechanical diversity, each featuring equal Arcade and Slot representation, while LATAM tilts heavily toward Arcade formats such as Plinko and Crash. North America and Oceania remain balanced but less varied, reflecting their more conservative content cycles.

Europe: The Sandbox

Europe is where you test. Both Arcade and Slots show up equally in top lists, and within each category, you see the widest variety of mechanics. If you’re launching something new, test it in Europe first—players there have the highest tolerance for experimentation.

Why is Europe so open? Regulatory maturity, market fragmentation across dozens of countries, and high smartphone penetration all contribute to the complexity of the market. From a product perspective, Europe is where you run your pilots and validate new mechanics before rolling them out globally.

Asia: Balanced But Explicit

Arcade and Slots are split evenly here, but tutorial clarity and volatility transparency matter more. Don’t assume players will figure out a new mechanic on their own—localize your onboarding, and be explicit about risk/reward structures.

Asian markets vary wildly, but a common thread is the expectation that the game will teach you how to play. Western design often assumes players will explore and learn by trial-and-error. In many Asian markets, that’s seen as poor UX.

LATAM: Arcade Country

This is Arcade territory. If you’re entering LATAM, lead with your fastest Arcade loops, keep onboarding frictionless, and make payments dead simple. Slots can come later, via instant-style crossovers that feel closer to Arcade pacing.

Why the Arcade preference? Mobile penetration is high, often on mid-range devices with variable network quality. Arcade games are lighter and faster. There’s also a cultural preference for games where you feel active and in control, even if that control is mostly illusory.

North America: Balanced But Conservative

Players here default to classic slots and are slower to adopt new Arcade mechanics unless they’re dressed up in familiar language (see: Slingo’s success). Emphasize responsible gaming messaging and transparent odds—it’s not just regulation, it’s user expectation.

North American players are sophisticated but cautious. They’ve seen decades of land-based casino gaming, so when they see a “slot,” they expect it to behave like a slot. That skepticism means you need to build trust first before introducing novel mechanics.

Oceania: Small Sample

Small sample, limited differentiation. Treat this as a test bed for Europe-validated mechanics, not a primary market for innovation. If you’re entering Oceania, bring proven mechanics that have already succeeded elsewhere.

What This Means for Product Roadmaps

If I were building a casino product roadmap today, here’s how I’d use this data:

For Arcade

- Lead with Plinko. It’s 54% of the top Arcade category for a reason. Build your onboarding around it, optimize it for mobile, and use it as your entry mechanic. If you only have a budget for one Arcade game, make it Plinko.

- Use Dice and Slingo as your second layer. Together, they’re nearly 30% of Arcade. They diversify your offering without diluting the fast-loop promise.

- Deploy Crash selectively. Don’t assume it’s global. Check your target market’s top-10 lists first. Where it works, it really works—but it doesn’t work everywhere.

For Slots

- Keep your core classic. 81% of top slots are traditional. Your base portfolio should be reels, paylines, and clear volatility. Optimize that experience before you get fancy. Faster load times, cleaner UI, better mobile performance—these improvements matter more than adding a new feature type.

- Add Instant Win layers where they fit. 13.5% is meaningful. Use instant reveals as a pacing tool, not a replacement for the core slot loop.

- Test Hybrid/Live as a retention hook. The 5.4% share is small, but strategic. Use it to extend session depth for players who are already engaged, not as your front door.

For Portfolio Strategy

Think of Arcade as your acquisition and activation engine—it’s fast, it’s mobile, it gets players in the door. Slots are your depth and retention engine—they keep players around.

Run cross-promotions: give Arcade players Slot bonuses after X drops, give Slot players Arcade boosters for hitting milestones. The data shows these are different play modes, but they don’t have to be disconnected experiences.

Looking Forward: Convergence Without Confusion

The trend lines point toward convergence: Arcade is borrowing its structure from Slots, and Slots is borrowing immediacy from Arcade. But the data shows you can’t just blur the lines and hope players figure it out.

The winning pattern: anchor in the familiar (classic Slots at 81%, Plinko at 54%), branch into the fast as a deliberate second mode, and connect with hybrids sparingly where markets show readiness.

Respect player intent. A player who opens an Arcade game wants immediacy. A player who opens a Slot wants rhythm. Don’t try to give them the opposite of what they came for.

Final Thoughts

This study confirmed some things we suspected and surprised us in others. Plinko’s dominance was bigger than expected. Crash’s concentration in specific markets was more pronounced than we thought. And the sheer stability of traditional Slots (81%) was a reminder that innovation doesn’t always mean reinvention.

If you’re building for 2025, build with mechanics first and themes second. Players are choosing what the game does long before they’re choosing what it looks like. Respect that, and your product will feel obvious to the right audience.

Because in the end, that’s what good design is—not surprising, just obvious once you see it.

Most Recent News

Get the latest information